Trends That Will Shape the Lifting and Rigging Industry in 2026

Learn the top lifting and rigging industry trends for 2026, including AI, energy infrastructure growth, inspections, automation, and workforce challenges.

The lifting and rigging industry is no stranger to change, but the pace of transformation heading into 2026 is different.

Forces that once felt distant or theoretical are now reshaping how facilities are built, how equipment is inspected, how work is performed, and what customers expect from their lifting and rigging partners.

From artificial intelligence and automation to massive energy infrastructure investment and a growing labor gap, the industry is approaching a tipping point. Companies that understand these trends and act on them early will be better positioned to support customers safely, efficiently, and competitively in the years ahead.

After speaking with our internal experts, this article looks at the most important trends shaping the lifting and rigging industry in 2026.

Table of Contents

- AI and Automation Will Have Major Impacts on Jobsites

- Energy Infrastructure Will Drive Unprecedented Demand

- Increased Investments in American Steel Production

- Changing Skill Requirements for Overhead Crane Technicians

- Workforce Shortages Remain the Industry’s Biggest Challenge

- Greater Emphasis on Digital Asset Tracking

- Inspections Are Shifting Toward Predictive Models

- What Industrial Customers Will Expect in 2026

- Final Thoughts

AI and Automation Will Have Major Impacts on Jobsites

In 2026, we will see companies continue to deploy AI into safety work systems, inspection workflows, and overhead crane systems. Rather than replacing people outright, AI is being used to improve safety, consistency, and decision making.

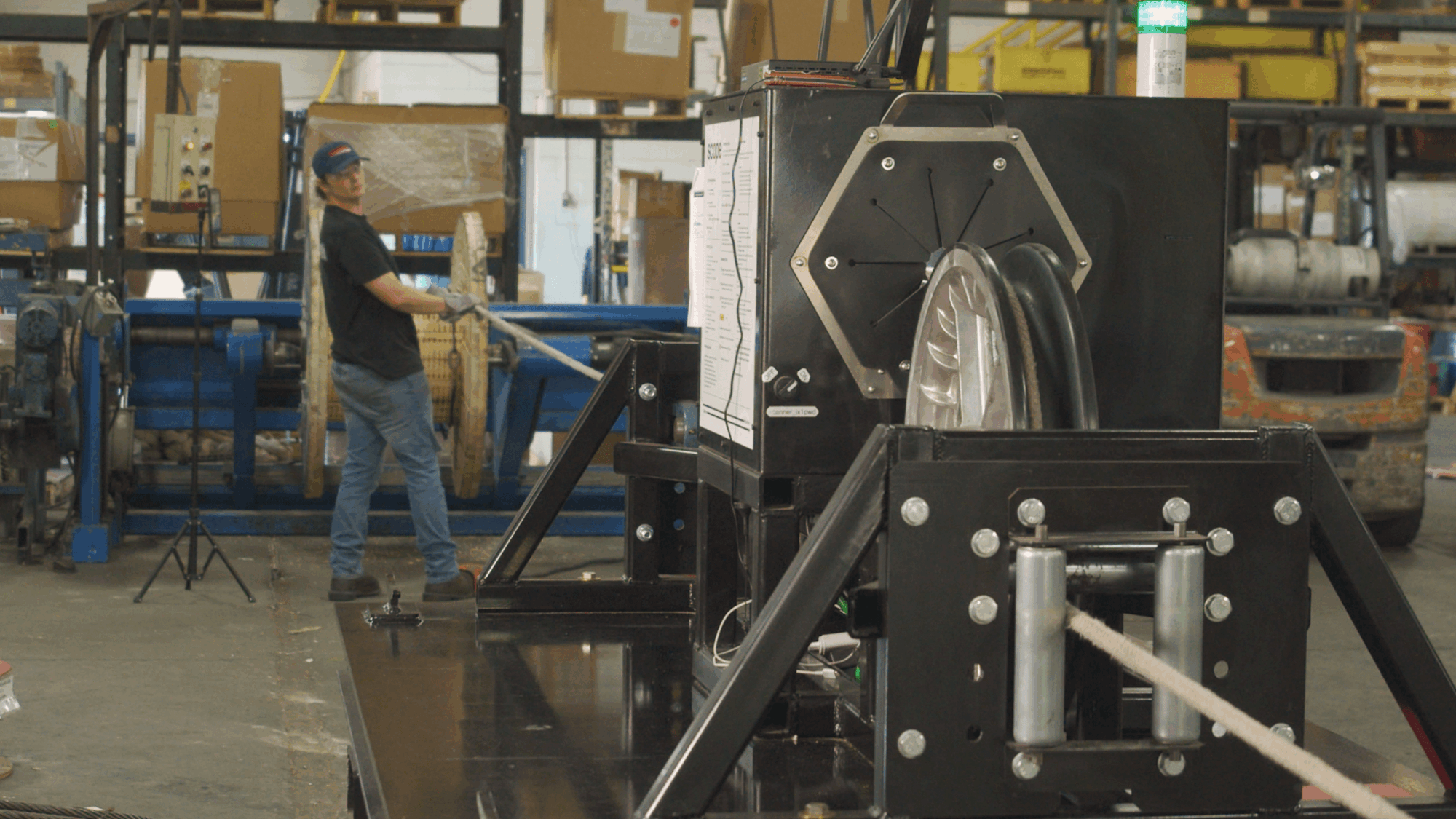

One of the most immediate impacts is in inspection and monitoring. AI-powered inspection tools like Scope are gaining traction in high-risk applications such as transmission lines, where failure can have catastrophic consequences. These systems allow inspectors to collect better data, identify issues earlier, and reduce reliance on subjective visual assessments alone.

AI is also expanding into jobsite safety. Computer vision systems are already being used in some facilities to confirm proper use of personal protective equipment, monitor designated walkways, and identify unsafe behaviors in real time. Looking ahead, similar technology is expected to be integrated into overhead crane systems to detect obstructions, machinery, and human presence within operating zones.

We’re also seeing AI used heavily in warehousing management for pallet racking design and efficiency.

While AI is not eliminating the need for expertise, it is raising expectations for accuracy, documentation, and proactive safety management.

Energy Infrastructure Will Drive Unprecedented Demand

Few trends will impact the lifting and rigging industry more than the rapid expansion of energy infrastructure. The growth of data centers, driven largely by AI adoption, is placing enormous strain on the existing power grid.

Consequently, the United States is entering a period of aggressive investment in power generation and transmission.

Transmission line construction and inspection are expected to increase significantly. Utilities and contractors are under pressure to expand capacity while maintaining safety over populated areas, highways, and critical corridors. This makes advanced inspection methods and properly maintained stringing and lifting equipment more important than ever.

Power generation itself is also diversifying. Nuclear, solar, hydro, and other energy sources are all part of the conversation. Recently, Alphabet, Google’s parent company, acquired a clean energy firm for their AI push.

In some cases, large facilities such as data centers are investing in their own dedicated power generation to reduce reliance on the grid. This shift creates long-term demand for cranes, rigging, inspections, and specialized lifting expertise across multiple energy sectors.

Increased Investments in American Steel Production

Like the energy sector, the United States is seeing increased resources poured into domestic steel facilities. Responding to major tariffs, which increased the price of imported steel, major steelmaking titans have responded by upgrading current facilities and building new ones.

Recently, US Steel out of Pittsburgh unveiled a multi-year plan to spend $14 billion on U.S. growth capital. This includes $11 billion towards its domestic facilities with a focus on manufacturing, research and development, and product innovation by the end of 2028.

Nucor is investing $4 billion into a large sheet mill in West Virginia, along with other mills and plants planned in the Pacific Northwest, Utah, Indiana, and Alabama.

Lifting and rigging companies who have the resources and experience to serve the steel sector will see increased opportunities in 2026 and beyond.

Changing Skill Requirements for Overhead Crane Technicians

Automation continues to advance in crane systems, but its impact is often misunderstood. While certain operator tasks may become more automated over time, the overall demand for skilled crane technicians is not going away.

In fact, the opposite is happening. Modern crane systems require a deeper knowledge of electrical components, drives, software, and diagnostics. Mechanical skills alone are no longer sufficient. Technicians must understand how hardware and software interact, how systems communicate, and how to troubleshoot increasingly complex equipment.

In the short term, automation may reduce barriers for operators by assisting with positioning, movement, and safety controls. In the long term, it will increase the importance of highly trained technicians who can install, maintain, inspect, and repair these systems.

Workforce Shortages Remain the Industry’s Biggest Challenge

Experienced professionals are retiring, and the pipeline of new talent is not keeping pace.

This loss of institutional knowledge affects nearly every role, from service technicians and inspectors to rigging specialists, salespeople, and operators. Many people do not enter the workforce with lifting and rigging as a career goal, which means most expertise must be developed through hands-on experience and training.

Companies that invest in structured training programs, mentorship, and long-term career development will be better equipped to manage this transition. Training will be a core business requirement and recruitment advantage rather than a bonus.

Greater Emphasis on Digital Asset Tracking

Digital tracking of rigging and lifting equipment has existed for years, but widespread adoption has been limited. Early systems were often too complex, labor intensive, or difficult to maintain.

That may be changing. Advances in mobile technology, automation, and data management are making digital asset tracking more practical. RFID tags and scanning tools can now store inspection histories, usage data, and serial information in a way that is easier to access and manage.

While not every operation will adopt these systems immediately, digital tracking is likely to gain momentum as it becomes more user friendly and better integrated with inspection and maintenance workflows.

Inspections Are Shifting Toward Predictive Models

Inspection practices are also evolving. While visual and operational inspections remain essential, the industry is moving toward more data-driven and predictive approaches.

Transmission lines are a clear example, but similar concepts are emerging for wire rope and other critical components. The ability to assess internal conditions, predict remaining service life, and address issues before failure could significantly reduce downtime and improve safety outcomes.

As inspection technology advances, customers will increasingly expect insight, not just pass or fail reports.

What Industrial Customers Will Expect in 2026

By 2026, many industrial customers will expect more from their lifting and rigging providers than equipment sales or inspection services alone. They will look for partners who can support advanced technology, provide meaningful training, and help navigate a rapidly changing operational landscape.

This shift will not happen overnight, but the groundwork is being laid now. Companies that invest in education, innovation, and long-term relationships will be best positioned to meet these expectations.

Final Thoughts

2026 will be an interesting time for the lifting and rigging industry. Companies willing to invest time and resources into internal training programs, digital asset tracking, and automation will be better prepared for the changes ahead.

As 2026 unfolds, subscribe to the Mazzella Learning Center so you never miss a new piece of informational content. You can also subscribe to our monthly newsletter, where we highlight recent industry news and events.

Copyright 2026. Mazzella Companies.